Longevity risk transfer soars to record high in 2020 as pandemic led to exceptional buy-in pricing

Pensions & benefits Pension risk transfer DB pensions

Analysis of insurers’ 2020 results by Lane Clark & Peacock (LCP) shows that, despite the Covid-19 pandemic, total longevity risk transfer by UK pension schemes in 2020 reached a record level of £55.8bn across buy-ins, buy-outs and longevity swaps. This puts 2020 ahead of 2019 at £51.6bn.

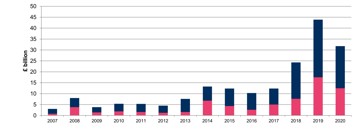

Total buy-in and buy-out volumes were £31.7bn, the second largest ever recorded in a single year, behind the bumper volumes in 2019 (£43.8bn) but representing a substantive increase from volumes in previous years. Longevity swaps reached £24.1bn, the largest total ever, ahead of £21.9bn in 2014, the next highest year.

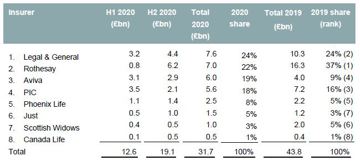

LCP’s analysis is based on the insurers’ final reported results for 2020, including Pension Insurance Corporation’s (PIC’s) results. Key findings are as follows:

- Four insurers vied for top spot in the buy-in/out market. Ultimately Legal & General (L&G) came out on top writing £7.6bn (24% market share) closely followed by Rothesay on £7.0bn (22%), Aviva on £6.0bn (19%) and PIC on £5.6bn (19%). This marked a big step up for Aviva with volumes 50% higher compared to 2019.

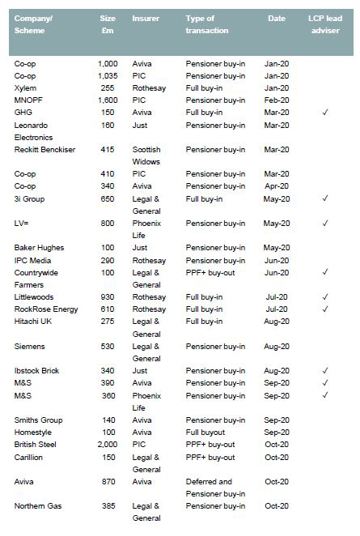

- The largest single buy-in/out in 2020 was an unnamed £3.3bn buy-in completed by Rothesay in December. The £2bn “PPF plus” buy-out for the Old British Steel Pension Scheme with PIC was the second largest buy-in/out of the year.

- 2020 saw a surge in mid-sized buy-ins/outs. There were only two buy-ins/outs over £2bn, as described above (compared to six in 2019) – so overall volumes were lower than 2019 – but at least 60 buy-ins/outs between £100m and £1bn, a 67% increase on the 36 in 2019.

- Six longevity swaps were announced by UK schemes in 2020 totalling £24.1bn (FY 2019: two longevity swaps totalling £7.8bn). These were primarily by financial institutions such as Barclays, Lloyds Banking Group, Prudential, and UBS, but also household names such as the BBC.

- There were two conversions of longevity swaps to buy-ins over the year, by the MNOPF and the LV= scheme, continuing a trend which started in 2018 and taking the total number of conversions to eight.

Imogen Cothay, Partner at LCP, commented:

“At the start of last year before the Covid-19 pandemic took hold we predicted that buy-in and buy-out volumes would top £25bn in 2020. It’s a mark of the resilience of the pensions de-risking market that volumes surpassed our expectations topping out over £30bn.

The pandemic led to some exceptional pricing in spring 2020, fuelled by falls in the price of assets used by insurers to back their pricing. We helped schemes of all sizes assess their options during the spring, with many deciding to accelerate their transaction timetable or to complete opportunistic transactions. Schemes who were able to move quickly, particularly those who were established buyers with umbrella contracts, were best placed to take advantage of the price opportunities.“

Charlie Finch, partner at LCP, added:

“2021 has begun with welcome news for many pension schemes in the form of a surge in gilt yields boosting funding levels and giving extra capacity to de-risk. Combined with a strong desire from trustees and sponsors to lock down their risks, this is likely to lead to sustained volumes of longevity risk transfer over the next year.

Insurer pricing remains favourable with strong competition – last year four insurers vied for top spot – and, where insurers target transactions, this is leading to some attractive opportunities.”

In 2020 LCP was lead adviser on nearly £8bn of buy-ins and buy-outs across over 30 transactions. This includes transactions for 3i, Countrywide Farmers, Deutsche Bank, General Healthcare Group, ICI, Littlewoods, LV= and Marks & Spencer.

Notes to editors

Buy-in/ buy-out volumes in the UK by insurer:

Source: Insurance company data. Only buy-ins and buy-out with a UK pension scheme are included. Total columns and rows may not sum due to rounding.

The chart and table below set out the volume of buy-ins and buy-outs each year since 2007.

Source: Insurance company data.

| £bn | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| Buy-ins/buy-outs | 2.9 | 7.9 | 3.7 | 5.3 | 5.2 | 4.4 | 7.5 | 13.2 | 12.3 | 10.2 | 12.3 | 24.2 | 43.8 | 31.7 |

| Longevity swaps | n/a | n/a | 3.8 | 4.3 | 7.1 | 2.2 | 8.8 | 21.9 | 9.4 | 2.6 | 6.4 | c5 | 7.8 | 24.1 |

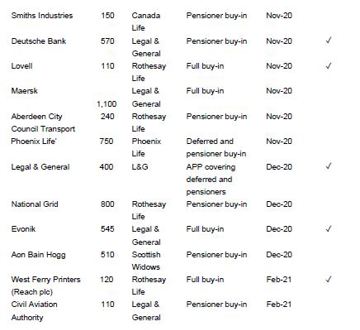

Buy-ins and buy-outs over £100m in 2020/21

Source: Insurance company data. Note for PIC the table includes H1 2020 transactions and public announcements for H2 2020 transactions. 2021 includes public announcements.

Named longevity swaps in 2020

| Company/ Scheme | Liabilities covered £m |

Structure | Intermediary | Reinsurer (where disclosed) | Date |

| Lloyds Bank | 10,000 | Sponsor subsidiary | Scottish Widows | Pacific Life Re | Jan-20 |

| Willis | 1,000 | Captive Insurer | Captive | Munich Re | Jun-20 |

| UBS | 1,400 | Pass-through intermediary | Zurich Assurance | Canada Life Re | Jul-20 |

| Prudential | 3,700 | Captive Insurer | Captive | Pacific Life Re | Nov-20 |

| Barclays Bank | 5,000 | unknown | unknown | Reinsurance Group of America | Dec-20 |

| BBC | 3,000 | Pass-through intermediary | Zurich Assurance | Canada Life Re | Dec-20 |

Previous data can be found in LCP’s De-risking Report 2020, “Finding certainty in uncertain times” available at www.lcp.uk.com/deriskingreport.